September 2016

There’s a bull market going on in U.S. domestic real estate. Have you noticed?

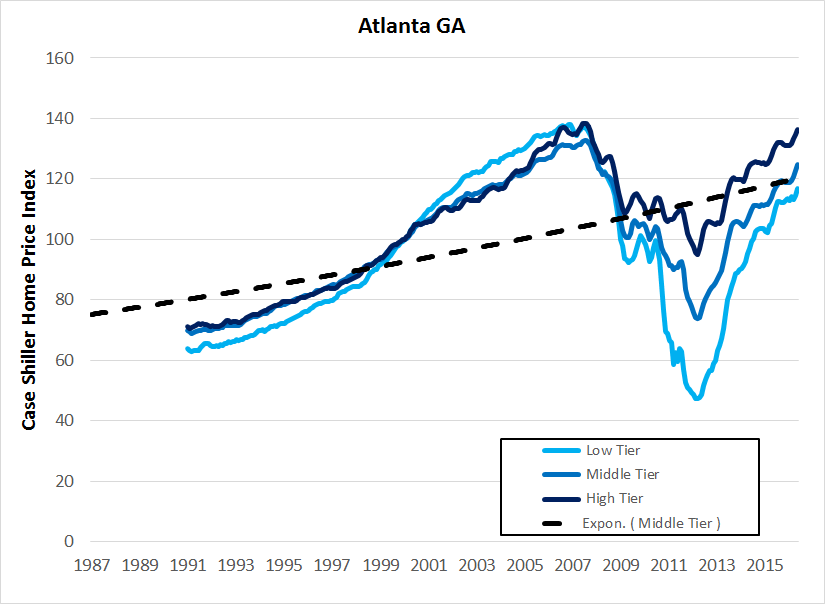

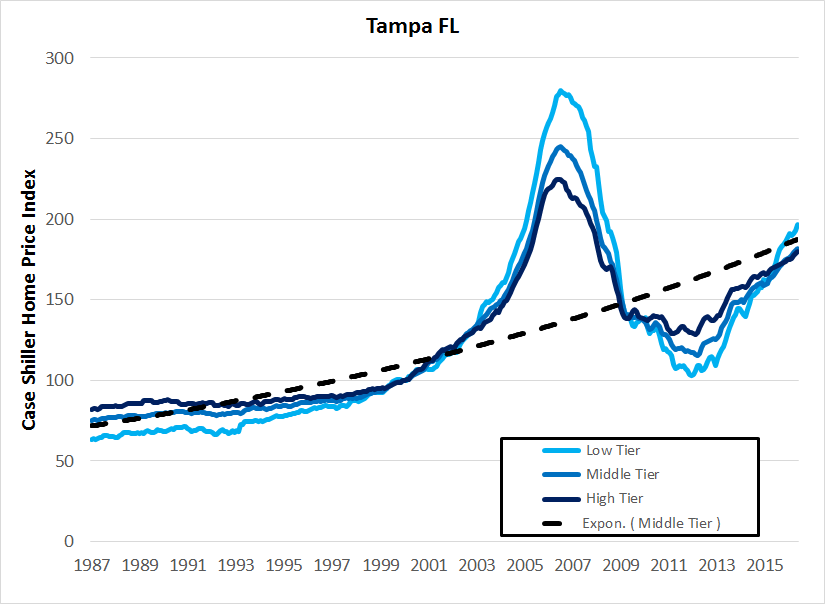

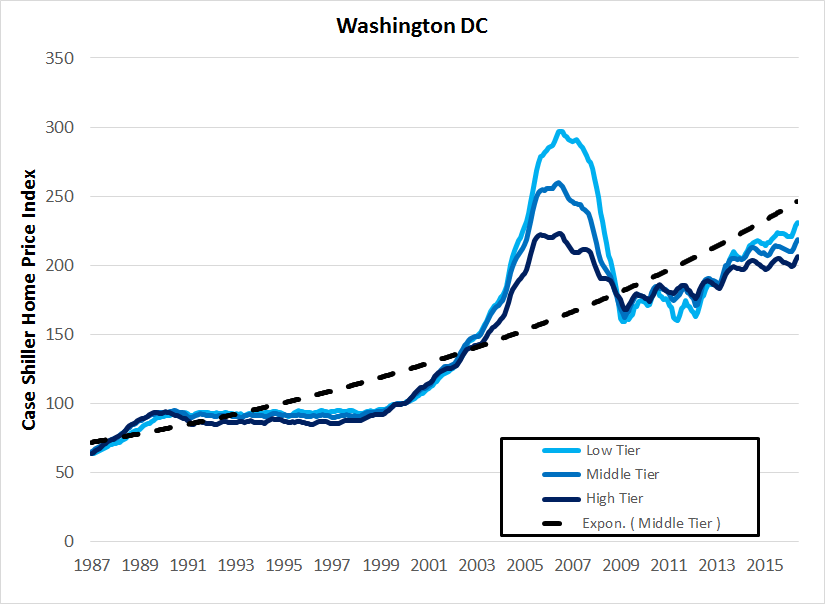

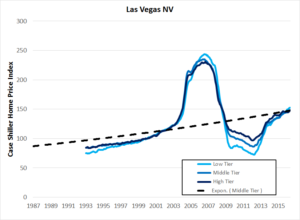

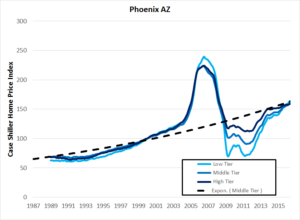

I know, I know. Home prices took a beating from 2006 – 2012, but then have risen 10-40% over the last 4 years in most markets. Prices may feel “frothy” because you see people bidding for homes and driving up prices. But looking at the long-term picture shows that, rather than being frothy, housing markets are still in the midst of a long-term up trend.

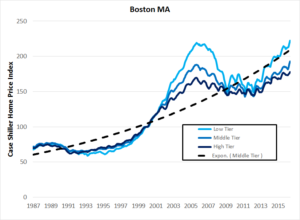

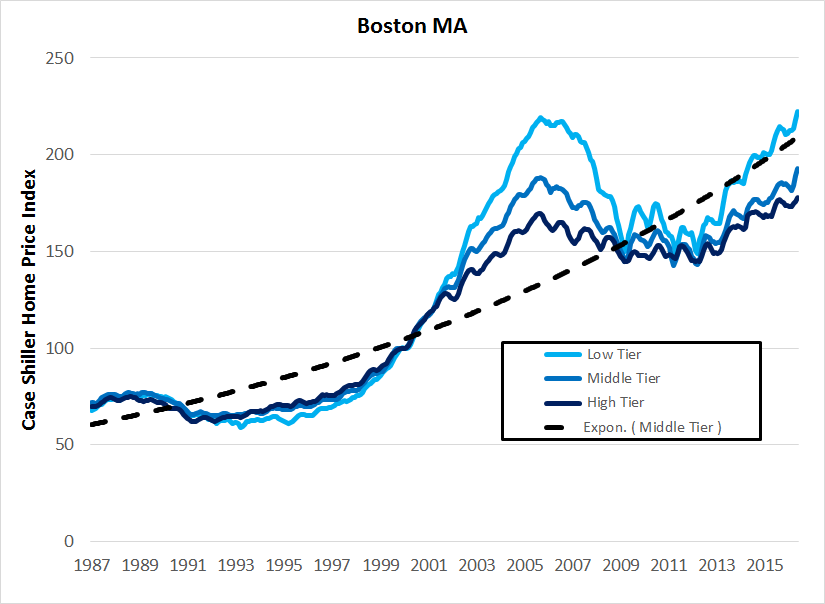

Take home prices in my current hometown in Boston:

A couple of observations:

- Length of the bear. The latest bear market lasted from roughly 1989 to 1995, around 6 years, just like the current decline from 2006 to 2012. Digging back to the data from the 1970s housing boom and decline shows almost exactly the same time profile of 6 years.

- Home prices are rising. This is the most basic point for anyone bearish on housing. If you’re bearish, how do you explain the last 4 years? Mortgage rates are exceptionally low (more on this below), which has contributed to the increase, but does not explain things entirely. Yes, it is a “sellers” market in the sense that buyers compete, buyers pay above asking, etc. But that’s exactly the mechanism of how home prices go up! As a buyer, you should be glad this is happening, as long as you’re not in bubble trouble (which we currently are not).

- Housing prices are slow to adjust. Year-over-year changes in home prices are pretty persistent, meaning that this year’s increase is a pretty good predictor of next year’s increase. When the ship gets moving in a positive or negative direction, it usually takes a couple of years to turn around. I’d rather be buying housing on the way up than the way down, even if it means making your purchase is a bit “competitive”, in that you have to outbid others. Way better to outbid and watch home prices rise for the next few years than get a “deal” only to watch home prices continue to fall.

- Behavioral metrics are promising. Some of the metrics that were off-the-charts in the mid-2000s housing bubble were the highest homeownership rate in history, high rates of 2nd homes, low foreclosure rates. None of these things are at historic norms anymore. Rather, they are right in the core of where they always are. No red flags here.

- Strong economy. Despite the doom-and-gloom you sometimes here out there, the economy has been fairly strong since 2011. We’ve had 5-6 years of improving employment, modestly growing GDP, really no reason to doubt a robust economy, at least not in the longer term. I’m optimistic that demand for good locations will continue to increase in the long run, especially here in the United States.

Emphatically: No, this is not a bubble. People love to throw around that term. But if currently used to describe domestic real estate, they are wrong. Just because prices are 10-30% higher than you remember them 3-4 years ago (very true in most U.S. markets) does not mean that they are incorrectly higher, or somehow speculative as a result. Look at the longer term trends in the charts below this post to see.

On the downside, I see two primary risks to housing, but on both of which I’m cautiously optimistic that the risks are low:

- Mortgage rates. It’s true that mortgage rates are at all-time lows. When else can you borrow a half-million dollars at 3% for the next 30 years? It’s a bit loony, if you ask me. But, that means it’s time to take advantage by locking it in. Rising rates are only problematic if you need to sell. For example: let’s say you lock in 30 years at 3%. Then, mortgage rates rise to 5%. That places downward pressure on prices (since folks are unwilling and unable to pay as high an asset value for the same income stream), but you’ve already locked in your 3%. So you don’t really care, as long as you continue to hold the property and keep the income stream. The only issue is if you have to sell, you probably get hurt by higher rates and lower prices. Moral of the story: keep a long duration and fixed borrowing on any housing investments, and you’ll be mostly insulated from this risk.

- Recession risk / stock market decline. The bull market in stocks is a bit long in the tooth, and I’m expecting a significant stock market decline in the coming months / years and possible coinciding recession. If that happens, it’s likely to put downward pressure on housing, at least in the near term. But, I’m not expecting this to disrupt the bull market in housing in any longer term way. Moral here: similarly, keep a long horizon with any housing investments so that you can hold through any stock market decline and into the subsequent recovery. Double lesson: if you’re thinking of investing in housing or buying a bigger house, be on the lookout to pick up some good deals if / when the next recession occurs.

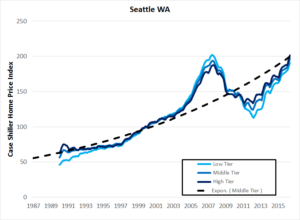

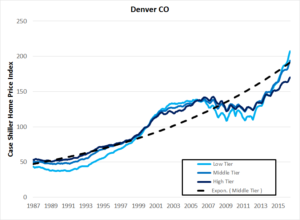

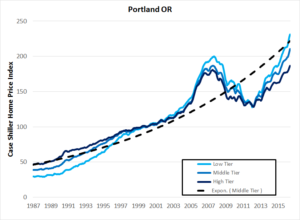

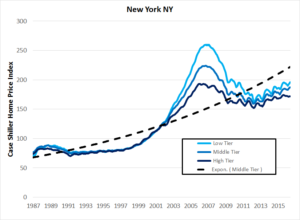

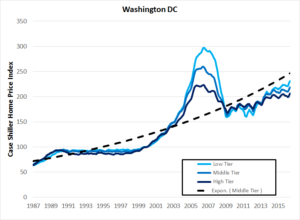

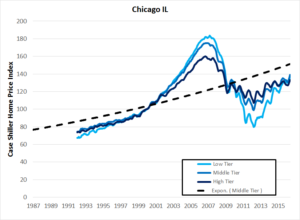

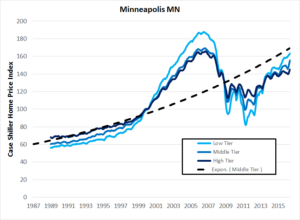

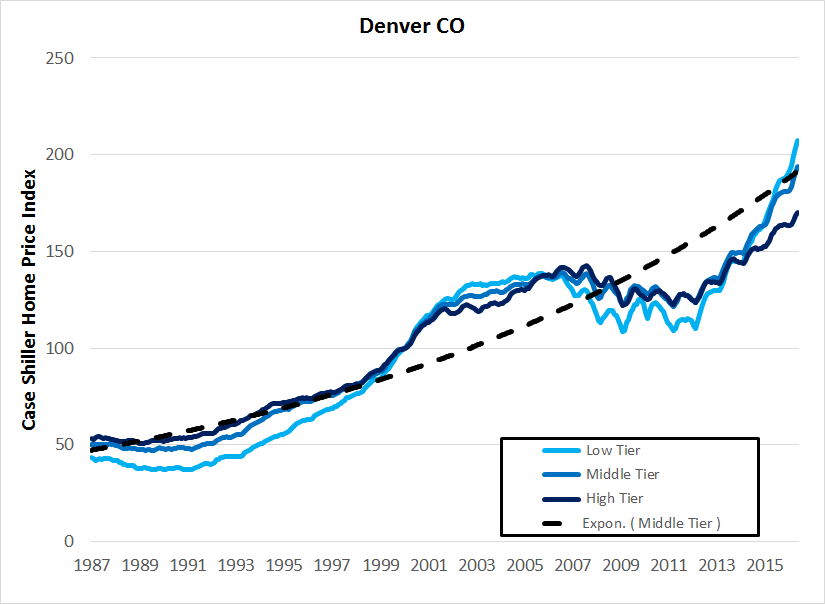

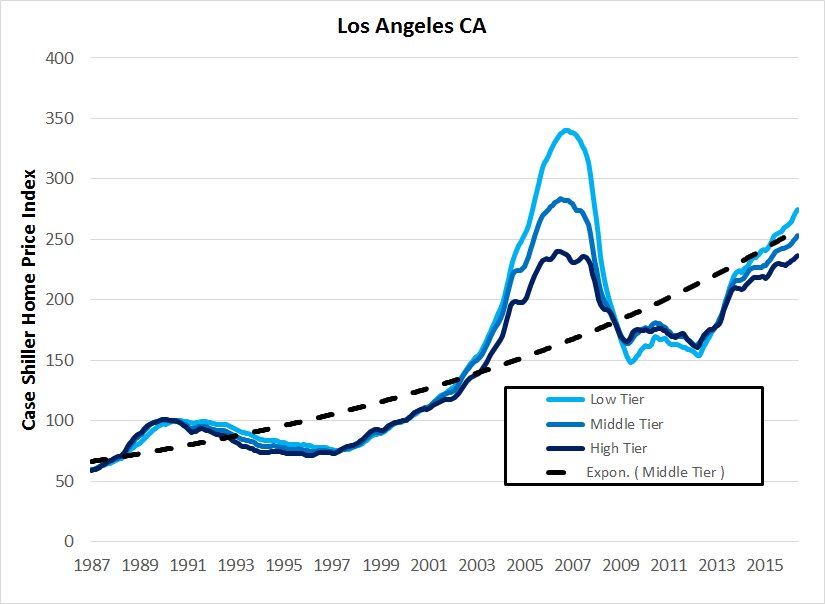

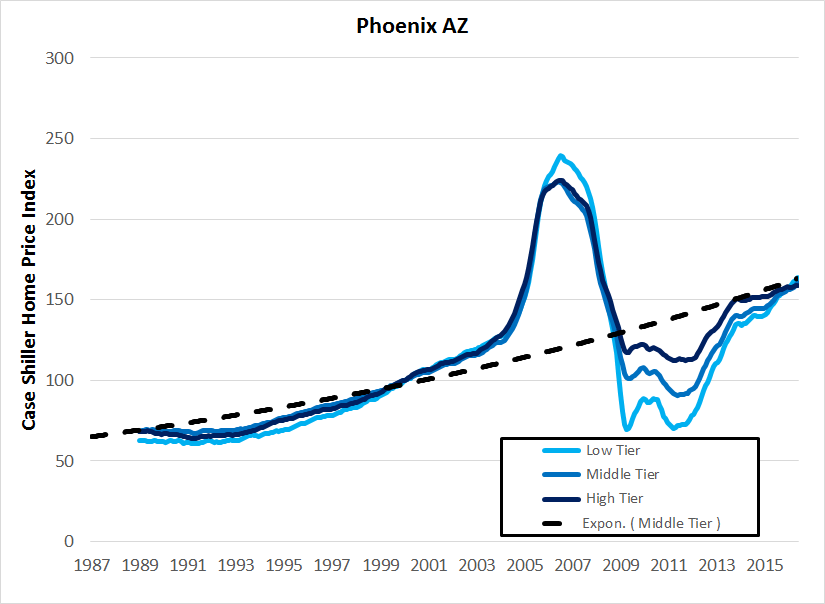

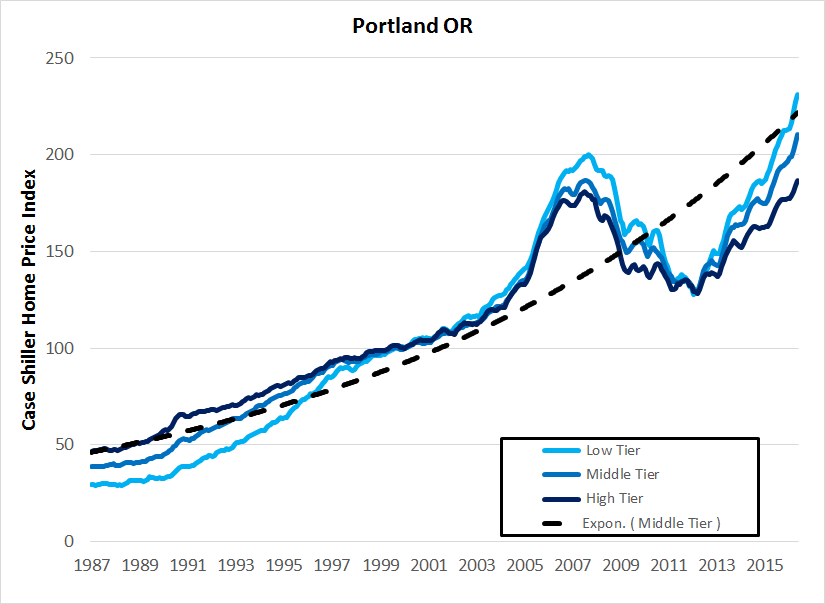

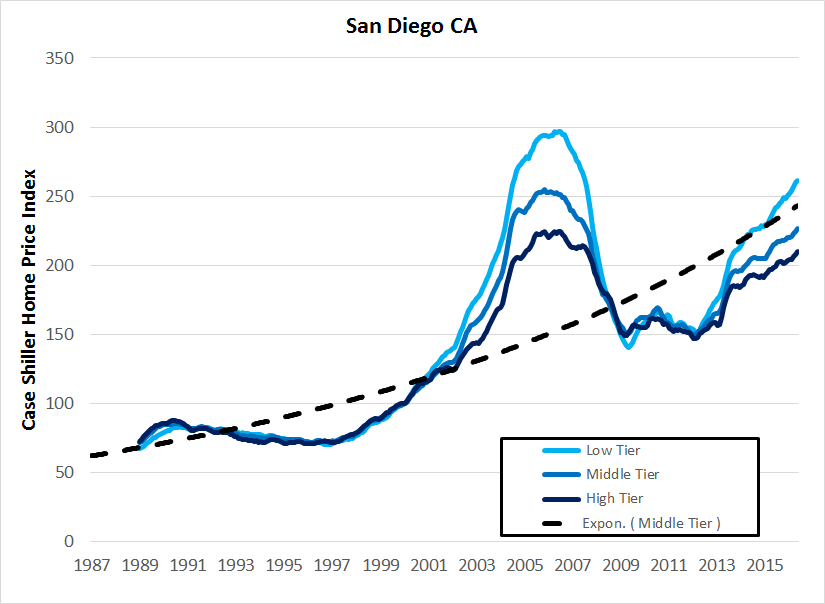

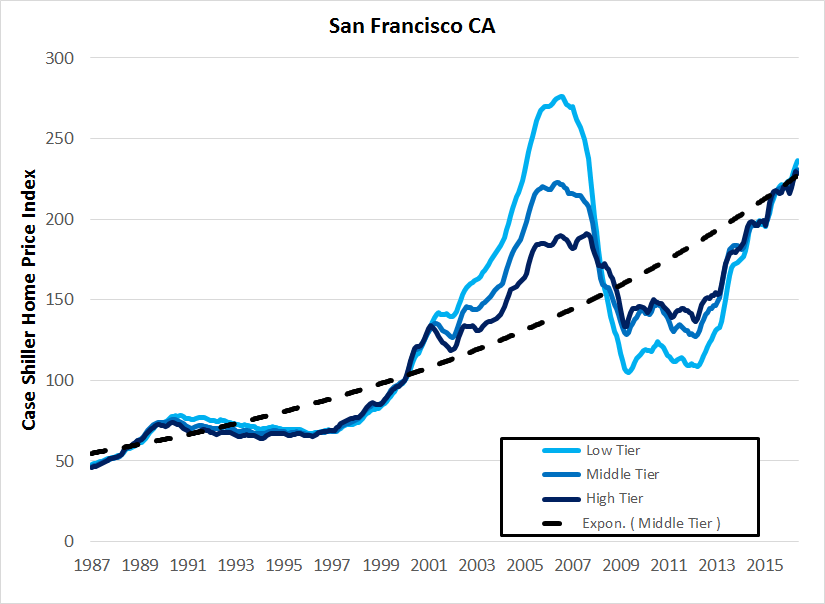

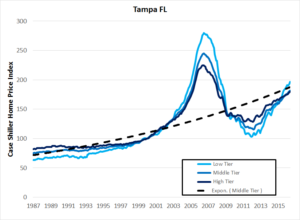

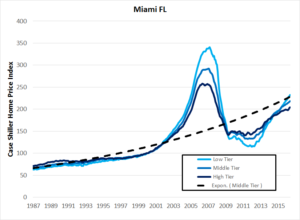

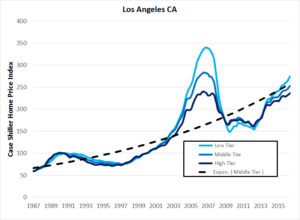

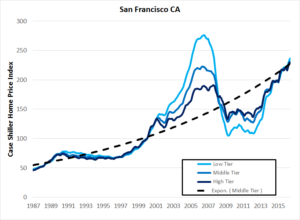

See below for some charts from the Case-Shiller housing indexes across the country. These indexes are my favorite measure of home price appreciation since they use a repeat-sales methodology — compiling pairs of sales of the same homes over time, thus controlling for quality (and taking account of any improvements) — and thus show real appreciation rates.

A couple of observations:

- Pacific Northwest. The Northwest cities like Seattle, Portland, and even Denver to some extent are the hottest markets in the country. Due to growing demand for tech and vibrant city growth, home prices in these cities are at double-digit levels. I think they will continue to go up, if you’re living there long-term, I’d still recommend buying if you can, despite the recent increases.

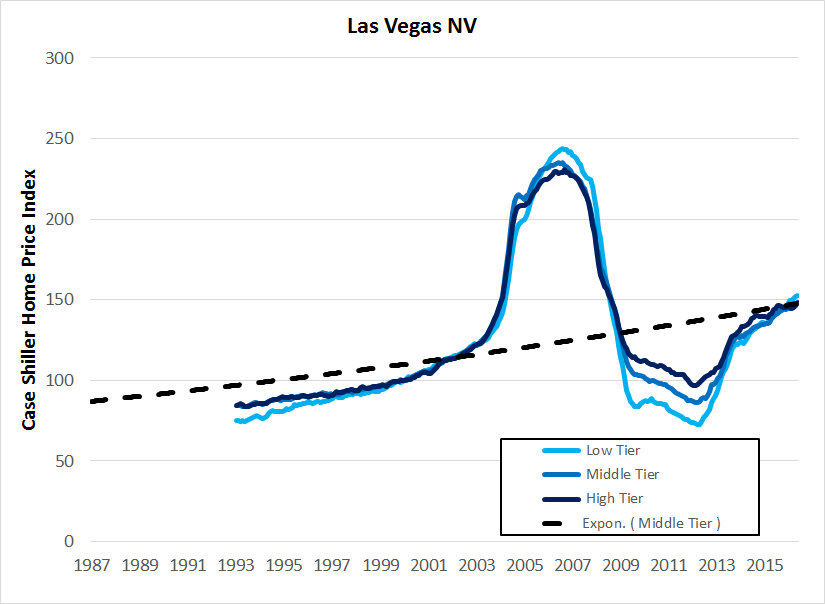

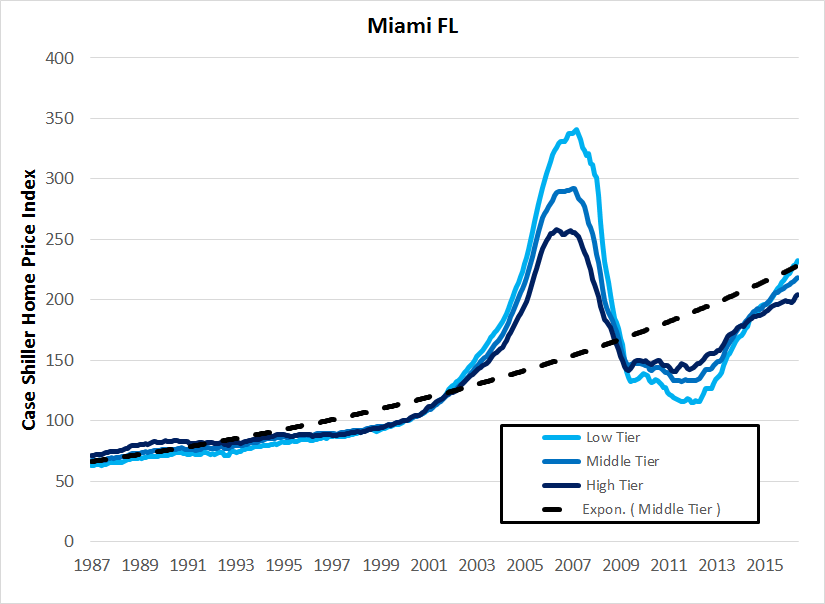

- Bubble cities. The most definitive housing bubble cities of the mid-2000s (Las Vegas, Pheonix, Tampa, Miami, and to some extent California) have more or less recovered from the bust. The 12 year period from 1999 to 2011 was a difficult time in these markets, with bubble returns in early years and bubble busts in late years. But, looking at the charts, I think we’re past all that now and you can be open to move reasonable consistent investment in these markets over time.

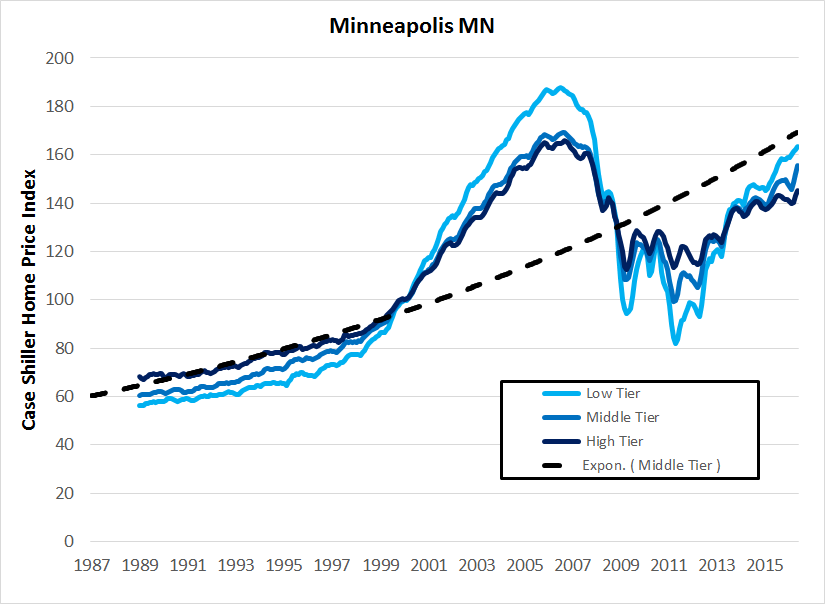

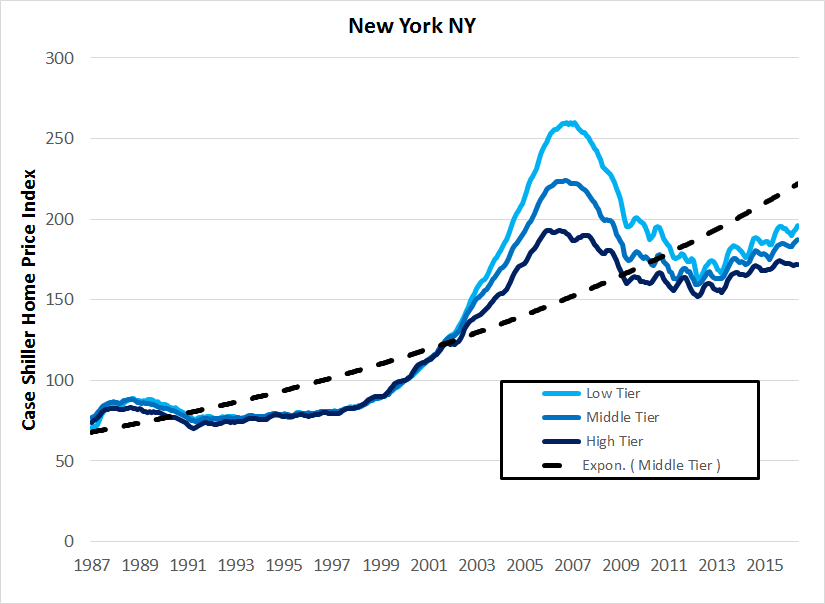

- Everywhere else. Other cities across the country, New York, Washington DC, Boston, Chicago, Minneapolis, have ended the bust cycle and have shown decent price appreciation in the last few years. I’m guessing this trend continues going forward. The key to successful investments in real estate (here and elsewhere) is buying in places where supply is relatively fixed (where new housing development is expensive or not possible) and long-term demand looks promising.

Key question: how much longer will it last? I’m not 100% sure how long this bull market lasts, but I don’t think it’s over. Maybe we’re halfway through. Maybe we’re 5 years into a 15 year cycle. But all things considered, I think we will look back on this time period as having been a great time to increase assets in real estate.

Happy investing!

All Case Shiller Home Price Indexes (2000 = 100)